-

Posts

4,897 -

Joined

-

Last visited

-

Days Won

7

Content Type

Profiles

Forums

Gallery

Everything posted by kueytoc

-

Temasek CEO Ho Ching to quit after rocky ride Reuters - Saturday, February 7 By Kevin Lim and Saeed Azhar SINGAPORE, Feb 6 - Ho Ching will step down as the chief executive of Singapore state investor Temasek Holdings, as it faces a difficult time after a turmoil in global markets slashed the value of its investments. Chip Goodyear, the former CEO of BHP Billiton, will replace Ho, wife of Singapore Prime Minister Lee Hsien Loong, on Oct. 1. The move will help Temasek to build a more global image from a fund viewed in some quarters as an agent of the Singapore government. Temasek, which had assets worth S$185 billion ($123 billion) as of March 2008 , is nursing losses from its high profile investments in Merrill Lynch and Barclays <BARC.L> as it aggressively expanded outside its core Asian market. "These are turbulent times and I'm sure she must have had a stressful time this year," said David Cohen, economist at Action Economics in Singapore. Temasek's $5 billion plus investment in Merrill alone has resulted in a loss of more than $2 billion. The state investor controls some of the most high profile Singaporean companies including Singapore Airlines <SIAL.SI> and Singapore Telecommunications <STEL.SI>, and has stakes in global firms such as Standard Chartered <STAN.L>. Temasek Chairman S. Dhanabalan said 55-year-old Ho's decision to step down was not linked to performance and it was too early to determine if investments made in the last two years will lose out in the long-term. "The team has already embarked on a different stance since mid-2007, and has begun to review its long-term plans under different scenarios prompted by the economic downturn," Dhanabalan said at a media briefing. "If we are to bring in new leadership, it would be just as good a time as any to involve a new leader in this review." Ho is stepping down after a five-year stint as the CEO. Goodyear, 51, left BHP Billiton in early 2008. He joined Temasek's board on Sunday. "Goodyear understands the financial crisis and having an expertise within metals and mining is very good for the future because that is where all the investors will be," Christoffer Moltke-Leth, head of sales trading at SAXO Capital Markets in Singapore. Asked whether he had the necessary experience to lead Temasek, Goodyear told a news conference he started his career as an investment banker at Kidder Peabody where he advised corporations on mergers and acquisitions and financing. "In the resources business, our payoff times are decades," he said. Ho Ching, who will also resign from the Temasek board, joined Temasek as a director in January 2002 and has been CEO since January 2004. (Additional reporting by Singapore bureau, Editing by Anshuman Daga)

-

Vortech MOD This modder certainly did as he made an acrylic box to store his vortech in the back of. This allows the so unpopular cords to be in the back of the tank where they belong while still getting the flow you want from the vortech. It’s amazing what we can come up with, we now are just wishing vortech would eliminate the power wires all together.

-

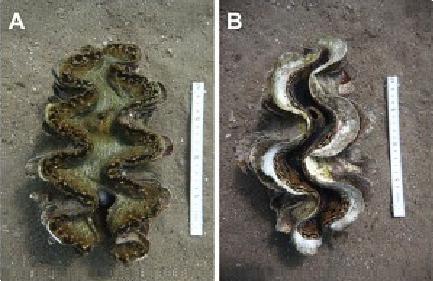

New Species of Tridacna clam discovered from the Red Sea A new species of Tridacna giant clam has been discovered in the Red Sea. Formerly believed to be a variant of Tridacna maxima, the newly described T. costata is now considered to be under serious threat of extinction. The new Tridacnid was found to make up less than one percent of the giant clam population in the Red Sea and although it was once widespread, overharvesting by humans is thought to be one of the main causes of its decline. T. costata is distinguished from T. maxima by more numerous and distinct rib-like folds of the shell as well as a subdued brownish mantle which exhibits numerous, wart-like protrusions. Although the clam has only been identified from the Red Sea, it is quite possible that this species occurs outside of this range and that it has been mistaken for a brown T. maxima all this time. Tridacna costata on the left and Tridacna maxima on the right. Photo by M. Naumann.

-

'Red Planet' coral from ORA Named the “Red planet’, perhaps a pun about mars, with striking red colors we can see why. Obtained from a hobbyist from Europe, they have been working on this coral for the past two years, showing very good growth out of this SPS. “It is predominantly vivid red with how pink tips and a metallic green base. fragments of this coral closely resemble what most might call a Acropora millepora or prostrata but it grows into a tightly spaced, flat topped, true table coral as it matures.†No word on price, but we don’t expect this species to break the bank.

-

ORA is ever closer to producing all white clownfish Contrary to what you might believe, this beautiful batch of white clownfish actually descend from ‘picasso’ clownfish which we have admired for having much better shape and far fewer deformities than their highly inbred black, ###### and snowflake ocellaris brethren. As you can see from these still tiny 1″ specimens, these fish have a good shape of the head, well formed jaws, full sized gills and fins and an even-ness of color which is simply stunning. Don’t expect to see these beauties at your LFS anytime soon as the first release of these yet to be named ‘Picasso’ clownfish descendents will surely go to some of ORA’s best customers for stratospheric prices.

-

Scientists discover marine hybrid hotspot Scientists from Australia have discovered a hotspot in the eastern Indian Ocean where unusually high numbers of natural hybrid fishes occur. The team from the ARC Centre of Excellence for Coral Reef Studies, at James Cook University's School of Tropical and Marine Biology in Queensland, found the hybridisation hotspot between the Christmas and Cocos Islands. Marine hybrid fishes are generally considered quite rare, but the area between the islands is home to a massive 11 reef fish hybrids spanning six different fish families - the highest number of hybrids ever recorded at a single location. In most cases, at least one of the parent species that form the hybrids is a rarity at the site, with less than three individuals found over an area spanning 3000 square metres. The scientists believe that the scarcity of potential mates mean that the fish are breeding with closely related species, rather than with their own kind. The authors said: "These islands also represent a marine suture zone where many of the hybrids have arisen through interbreeding between Indian and Pacific Ocean species. "For these species, it appears that past climate changes allowed species to diverge in allopatry, while recent conditions have facilitated contact and subsequent hybridization at this Indo-Pacific biogeographic border. "The discovery of the Christmas-Cocos hybrid zone refutes the notion that hybridization is lacking on coral reefs and provides a natural laboratory for testing the generality of terrestrially derived hybridization theory in the marine environment." The hybrids found at the site include: Acanthurus leucosternon x Acanthurus nigricans Naso elegans x Naso lituratus Melichthys indicus x Melichthys vidua Chaetodon guttatissimus x Chaetodon punctatofasciatus Chaetodon ornatissimus x Chaetodon punctatofasciatus Chaetodon ornatissimus x Chaetodon meyeri Chaetodon lunulatus x Chaetodon trifasciatus Thalassoma jansenii x Thalassoma quinquevittatum Centropyge flavissima x Centropyge eibli Centropyge eibli x Centropyge vrolikii Centropyge flavissima x Centropyge vrolikii For more information see the paper: Hobbs JP, Frisch AJ, Allen GR, Van Herwerden L (2008) - Marine hybrid hotspot at Indo-Pacific biogeographic border. Biol Lett. 2008 Dec 23. This post has been promoted to an article This post has been promoted to an article

-

May dip into reserves again Singapore finmin says economic woes deepening Reuters - Friday, February 6 SINGAPORE, Feb 5 - Singapore's finance minister said on Thursday the economic downturn was worsening and the government may have to tap its multi-billion dollar pool of reserves for another fiscal stimulus package next year. Singapore was the first country in Asia to fall into recession last year and Finance Minister Tharman Shanmugaratnam reiterated a forecast made before the country's January stimulus package that the economy could shrink up to 5 percent this year. "We are seeing continued momentum in the decline week by week," Tharman told parliament at a budget debate. Singapore, a tiny city-state of 4.6 million, last month took the unprecedented step of drawing on its reserves to help finance a S$20.5 billion stimulus package as its economy shrunk for the third straight quarter. [iD:nSP404398]. Tharman said the stimulus package was sufficient. It will result in a budget deficit of about 6 percent of gross domestic product for 2009/2010 before investment income and the top-up from reserves. "There is a possibility the government may have to go back to the president and the CPA in a year's time to seek a further draw," Shanmugaratnam said, referring to the Council of Presidential Advisers. Singapore's president, whose role is otherwise largely ceremonial, is the formal guardian of the reserves. A senior politician said on Sunday the government would dip into the reserves only in times of crisis and to pay for welfare. "As a general principle, the government must continue to fund such programmes out of revenues raised in the current term of government, not past reserves," former Prime Minister Goh Chok Tong said Singapore's two sovereign funds, Temasek [TEM.UL] and the Government of Singapore Investment Corp, or GIC, together manage an estimated $400 billion in assets. (Reporting by Kevin Lim; Writing by Nopporn Wong-Anan; Editing by Jan Dahinten)

-

OMG! Look at these hybrids and rare fishes!

kueytoc replied to Digiman's topic in FOWLR (Fish-only with Live-rock)

Hopefully, some lucky reefers can 'ta-pao' the elusive hybrid BLACKIE 'once-in-a-while' lor. -

U haven't see its FULL GLORY mate !

-

Shhhh...'low-profile' lah.

-

LFS BIG UPDATE 1st feb to 10th feb

kueytoc replied to yikai's topic in Weekly LFS Stocks Report / LFS Info Centre

-

OMG! Look at these hybrids and rare fishes!

kueytoc replied to Digiman's topic in FOWLR (Fish-only with Live-rock)

-

-

-

Chartered Semiconductor announces Q4 loss, cuts 540 jobs in Singapore Channel NewsAsia - Friday, January 30 SINGAPORE: Chartered Semiconductor, one of the world’s largest microchip makers, announced on Friday it would cut 600 jobs worldwide — about eight per cent of its total workforce. This will help the company save some US$16 million annually in payroll and benefits. Channel NewsAsia understands that about 540 workers in Singapore will be affected by the retrenchment exercise. Chartered said it is currently working with the unions on a retrenchment package for affected staff. This came as the company, which is listed in Singapore as well as on the Nasdaq in New York, reported a fourth—quarter net loss of US$114 million. It said revenues for the three months ended December 31 were down by 24 per cent at US$351.7 million, compared to the third quarter of 2008. The fall was largely due to the "unprecedented rate of decline in semiconductor demand worldwide". For the full year 2008, Chartered reported a net loss of US$92.6 million compared with a net income of US$101.7 million the previous year. Looking ahead, Chartered said the negative macroeconomic environment and weakening demand will continue to affect its business in a significant way. It is already projecting a 32 per cent fall in revenues for the first quarter of 2009, compared with the fourth quarter of 2008.

-

7,000 S'poreans lost jobs in last quarter of 2008 Thousands layed off in Singapore in fourth quarter: govt AFP - Saturday, January 31 SINGAPORE, Jan 30, 2009 (AFP) - Companies in Singapore laid off 7,000 workers in the last three months of 2008, as the economy slipped deeper into recession, the government said Friday. More than half of the layoffs were in the key manufacturing sector, which has been hit by a sharp decline in demand for the city-state's exports, the Ministry of Manpower said in a statement citing preliminary estimates. The seasonally adjusted unemployment rate rose to 2.6 percent in December, up from 2.2 percent in September and 1.7 percent in December 2007, it said. The 7,000 workers laid off in the December quarter compared with 2,346 employees who lost their jobs in the preceding three months and 1,966 for the same period in 2007, the ministry said. For the whole of 2008, there were 13,400 workers laid off, up from 7,675 the year before. Employment also slowed significantly to 26,900 in the fourth quarter of last year, from 55,700 people who were hired in the preceding quarter and 62,500 in the same period in 2007. Finance Minister Tharman Shanmugaratnam warned last week the country is facing its worst recession since independence 44 years ago and announced a record stimulus package of more than 13 billion US dollars. Singapore in October became the first Asian economy to enter recession, falling victim to a global slowdown sparked by a crisis in the US housing market.

-

Finance Min Tharman: The worst is yet to come Global economic crisis will take more than a year to unravel: Tharman Channel NewsAsia - Friday, January 30 SINGAPORE: Singapore’s Finance Minister Tharman Shanmugaratnam says it will take more than a year for the global economic crisis to unravel. Speaking to Bloomberg Television on Thursday, Mr Tharman says the world has yet to see the worst of the downturn, as banks are still in contraction mode and focused on recapitalisation, rather than lending. He said, "The foreign banks are still in the mode of contraction. I think every large global bank is still looking at building up its capital, much more than it’s looking at extending new loans. So we are still at that phase of the crisis where recapitalisation is still the priority and estimates of the extent of bad assets on their books are still on the upswing. So, we haven’t seen the worst yet." Mr Tharman says that is why it is a good move for governments in the West to help these banks recapitalise and incentivise lending. The minister also responded to criticism from some quarters that Singapore’s economic growth model makes the country vulnerable to swings in global demand. Mr Tharman says the country’s future and fortunes are tied to global markets. As for investments by Temasek Holdings and the Government of Singapore Investment Corp in overseas banks, Mr Tharman says they have so far been so good, performing credibly by international standards. — CNA/yt

-

So U are the ONE who got tis GEM piece...Nice catch mate !

-

CORAL Magazine..."The World's Best Reefkeeping Magazine"

kueytoc replied to kueytoc's topic in General Reefkeeping_

Mag is currently in production. However, looking at the front cover page, this issue should be interesting. -

Hailed by critics as "the world's best reefkeeping magazine," CORAL is written by leading aquarium experts and marine biologists, lavishly illustrated with breathtaking images, and filled with inspiration for beginning to expert aquarists. Contributors and advisors include: Daniel Knop, Anthony Calfo, Julian Sprung, Alf Jacob Nilsen, J.E.N. "Charlie" Veron, Ph.D., Martin A. Moe, Jr., Charles Delbeek, Prof. Ellen Thaler, Robert M. Fenner, Dr. Dieter Brockman, Thomas Frakes, Svein A. Fossa, Scott W. Michael, Matthew L. Wittenrich, Gerald R. Allen, Ph.D., Roger Steene, Wolfgang Mai, and many others. Every big issue brings: * Fish & Invertebrate Species Profiles * Reef Life Rarities * World-Class Aquarium Systems * Marine Aquarium Tips for Beginners * Tropical Zone Travel & Discovery * Thought-Provoking News, Portraits, Interviews, Technology Updates, and much more. The January/February 2009 Issue of CORAL is currently in production and will be mailed to subscribers and shipped to local aquarium shops and booksellers in January with an official publication date of January 27th. Feature Articles by Daniel Knop and others will highlight the beautiful and fascinating TRIGGERFISHES, including all species of interest to marine aquarists and with a guide to members of the Family Balistidae that are considered safe in a reef aquarium. World-class images by legendary reef aquarist Rolf Hebbinghaus and others will illustrate the must-read cover features. Other articles will explore the underwater treasures of Madagascar, a review of the latest developments in reef lighting by Anthony Calfo, a must-read profile of the Rose Anemone (Entacmaea quadricolor) by Bob Fenner, an inside look at Matt Wittenrich's success in breeding the Green and Spotted Mandarinfishes with a sidebar by Julian Sprung, Prof. Ellen Thaler's iconoclastic approach to mixing fishes and corals ("No risk, no fun!"), and much more. Although, for reasons beyond our control, this issue will be later than former subscribers expected, we think it will be worth the wait and very likely to become a collector's issue.

-

Job losses to cut Singapore population by 4 pct: bank AFP - Wednesday, January 21 SINGAPORE, Jan 20, 2009 (AFP) - Tiny Singapore's population is expected to decline by 200,000 as companies lay off a massive number of foreign workers during a worsening recession, Swiss banking giant Credit Suisse said. The job cuts, which would include highly-paid expatriates and permanent residents, will hurt domestic consumption and help push the economy into its sharpest decline since independence in 1965, said the report received by AFP on Tuesday. A loss of 200,000 jobs would amount to more than four percent of the population. Credit Suisse said the economic slowdown in the trade-sensitive city-state had so far been driven by a sharp decline in exports, while domestic demand held up. But for this year, "consumption growth should also slow, in part because of our expectation that Singapore's population will potentially drop by 200,000 by 2010" due to job losses, it said. "Historically, Singapore's foreign population has tended to expand during high growth periods and contract during recessionary periods," the report said. "Given the strong foreigner population growth in recent years, this trend is unlikely to change in this downturn." Of the 800,000 jobs created from 2004 to the third quarter of last year, Credit Suisse estimated that more than 500,000 were filled by foreigners and permanent residents. About 200,000 of those jobs were in manufacturing and almost another 200,000 were in the financial and business services. Most of these jobs were filled by expatriate workers who earn more than the average Singaporean, it said. "As a result, job losses are likely to hit the Singaporean economy hard because they affect more highly paid workers and could result in a semi-permanent drop in the population," the report said. As of mid-2008, Singapore had a total estimated population of 4.84 million people, including 3.64 million citizens and permanent residents, Statistics Department data showed. The rest, more than one million, are foreign workers and their families. With the impact of falling domestic demand exacerbating declining exports, the economy was likely to contract by 2.8 percent this year, Credit Suisse said. This would leave the economy in its worse shape ever, after 2001 when it shrank by 2.4 percent. The economy grew 1.5 percent last year compared with 7.7 percent in 2007. Despite the expected layoffs, Singapore's Acting Minister for Manpower Gan Kim Yong said the city-state would still need overseas labour. Gan said that foreign workers allowed Singapore companies to remain globally competitive and contributed to keeping jobs within the country. "If companies become uncompetitive in Singapore, they may decide to relocate to other countries and we will lose more jobs. This will be a lose-lose outcome," he said in parliament Monday.

-

S'pore ministers' pay may be cut 20 pct this year-media Reuters - Tuesday, January 20 SINGAPORE, Jan 20 - The annual salaries of Singapore's ministers and senior civil servants are expected to fall by 12 to 20 percent this year in line with the shrinking economy, local media reported on Tuesday. Defence Minister Teo Chee Hean, who is also minister in charge of the civil service, told Parliament on Monday that senior permanent secretaries and entry-grade ministers will likely receive S$1.54 million , which is a drop of 20 percent from last year. Younger officers in the elite Administrative Service -- typically top performers in their early to mid-30s -- will receive S$351,000 or about 12 percent less, Teo added. "As the salaries are linked to economic performance, the 2009 salaries may be subject to further adjustments given the volatility of the economy," he said. Singapore pegs ministers and senior civil servants' pay to top earners in the private sector, saying it needs to pay well to retain talent in the government service. Prime Minister Lee Hsien Loong last year received an estimated S$3.76 million, about five times the annual salary of outgoing U.S. President George W Bush. Singapore, which became the first Asian economy to slip into recession last year, has forecast the economy could shrink by up to 2 percent this year. It is considering dipping into its reserves worth hundreds of billions of dollars for the first time to tackle the slump, officials were quoted as saying on Monday. [iD:nSP388780] The government could draw on the central bank's foreign reserves that totalled $174.2 billion in December, or its two secretive sovereign funds GIC and Temasek that had at least a combined $230 billion in assets in reported figures last year.

-

NTUC says more youths aged under 30 will start feeling impact of downturn Channel NewsAsia - Monday, January 19 SINGAPORE: More youths aged under 30 will start to feel the impact of the recession as the year progresses. The unemployment rate for this group of youths was 4.1 per cent recently but NTUC said it is likely to go up this year. However, the labour movement said, the figure is still far better than those in other countries at the moment. And, among the 55,800 unemployed in Singapore, about 31 per cent of them are youths. The present economic downturn is the first major one for many young adults. To help prepare them if they get the axe, NTUC’s Employment and Employability Institute (e2i) held a retrenchment simulation exercise. NTUC said there are about 6,000 immediate job vacancies across all sectors at the moment. But the main challenge when it comes to young adults is managing their own expectations. NTUC Assistant Secretary General, Josephine Teo, said: "The terms and conditions of employment may not be what they expect. So the purpose of this activity (retrenchment simulation exercise) is also to help them to understand that challenges are now different and therefore they also have to adjust their expectations accordingly." Despite the downturn, Defence Minister Teo Chee Hean said Singapore could still rely on its strong dollar and reserves. "Because if the whole economy is in doubt or it collapses and nobody even believes in your currency anymore — like it has happened in some countries like Iceland — then we’re really in deep trouble," he said. — CNA/ir

-

Civil servant rapped over cooking holiday Channel NewsAsia - 1 hour 2 minutes ago SINGAPORE — A senior Singaporean civil servant has been reprimanded for publicising his family’s vacation at a top French cooking school when his country is suffering from a recession, a minister said Monday. "It struck a discordant note during the current difficult economic circumstances when it is especially important to show solidarity and empathy for Singaporeans who are facing uncertainties and hardship," Defence Minister Teo Chee Hean said in parliament. The civil servant, Tan Yong Soon, wrote early this month in a local newspaper about his family’s experience learning to cook at Le Cordon Bleu in Paris. He said he attended with his wife and son. Tan, permanent secretary at the ministry of environment and water resources , showed "a lack of sensitivity" and poor judgement, the minister said. The head of the civil service has already spoken to Tan about the matter, the minister added. "What the civil servant in question, Mr Tan, does during his vacation leave, this is (a) private decision," said Teo, who is also minister in charge of the civil service. "However, I was disappointed with what he wrote in to The Straits Times." According to the newspaper, a basic cuisine course at Le Cordon Bleu costs S$15,500. — AFP/vm