-

Posts

4,897 -

Joined

-

Last visited

-

Days Won

7

Content Type

Profiles

Forums

Gallery

Everything posted by kueytoc

-

PM Lee: Don't be depressed Workers, employers urged to have sense of balance when dealing with retrenchments Channel NewsAsia - Monday, March 2 HUA HIN, Thailand : Prime Minister Lee Hsien Loong has urged workers and employers to have a sense of balance when dealing with retrenchment forecasts during these difficult economic times. He added that despite the gloom, Singapore is not in a bad position. Mr Lee said this during his interview with Singapore media at the end of the ASEAN Summit in Hua Hin on Sunday. There have been several reports recently of retrenchment forecasts in Singapore this year, with the latest being from DBS Bank which put the figure at 99,000. This prompted some ministers to emphasise the need to be focused and not be overwhelmed by the numbers. Mr lee said: "Everyday we see bad news, another 50 here, another 100 there, and such and such job cuts. After a while, even if you were not depressed, we become depressed. "There are things happening which are positive, there are things which will turn good in time, there are things in the pipeline; the IR (integrated resort) is coming along, two IRs are both coming along. Every time I drive past the Marina, I watch to see whether another level has come up or not and it has nearly reach the top now." Mr Lee stressed Singapore has the resources and has done the right things with this year’s Budget. He said: "I know people say why didn’t you help the households more directly. But the right way to help people now is not to give them vouchers or coupons to spend, but to help them keep their jobs, and this is where the emphasis of the Budget was, and that is something which we have to explain to the people and help them to understand." On investments by the Government Investment Corporation of Singapore, Mr Lee said they are long—term in nature. In bad years, there would be shrinkage, but overall they have performed well. He said: "If you jump up and down and you want to break even and make money every quarter, you will not be able to have a sensible policy. You will end up not protecting your value, you cannot discuss Citigroup as Citigroup. "We have to look at the whole portfolio and overall what is the performance, some ups and some downs, some good years, some bad years and overall over 20 years, it has done well." Mr Lee said how soon Singapore will recover from this downturn will depend on the world. What is important now is for the country to remain stable and emerge as a strong economy when the recovery comes. — CNA/ms

-

PM Lee: Expect long years of slowdown Singapore PM warns of lengthy global slump AP - Saturday, February 28 CHA-AM, Thailand - Singapore's leader Prime has warned the global economic slump may last several more years if the U.S. doesn't fix its creaking banking system, a newspaper reported Saturday. Prime Minister Lee Hsien also called on President Barack Obama to resist pressure from the American public for protectionist policies such as trade barriers to protect homegrown industries during the downturn. Lee, in Thailand for the 14th annual summit of Southeast Asian leaders, told the Bangkok Post in a pre-summit interview that the U.S. _ the world's largest economy _ will be in recession for at least the rest of the year and could continue to stumble after that. "So you could easily be in for several years of quite slow growth worldwide. And I think it's best that we prepare for that, and prepare our people," said Lee, son of Lee Kuan Yew, the city-state's leader from 1959 to 1990. Leaders and top officials from the Association of Southeast Asian Nations _ a region of more than 500 million people _ are gathered in the Thai resort town of Cha-Am, 120 miles (200 kilometers) south of the capital Bangkok, for the grouping's 14th summit. The meeting, usually dominated by human rights issues, is overshadowed this year by the global economic meltdown, which has already dragged the export-dependent region's most advanced economy _ Singapore _ into recession. Thailand's economy shrank in the fourth quarter and others like Malaysia and Indonesia are facing rapidly slowing growth as exports crumble. Singapore warns that its economy will contract as much as 5 percent this year. The region _ which groups one of Asia's richest nations with some of its poorest _ is at the mercy of global economic winds, particularly from the U.S., a major export market for Southeast Asian countries. U.S. banks are loaded with hundreds of billions of dollars of toxic assets after the overheated American housing market imploded last year, sending shock waves through the global financial system. Lee said fixing ailing banks in the U.S. and some major European nations will require politically difficult and costly decisions such as nationalization, massive injections of capital, or governments buying the banks' bad assets. All involve nationalizing the banks "one way or another," he said. "I think the choices are not easy but they have to be made. If you do not make a choice then the outcome will be like what happened in Japan in the 1990s and it went on for more than a decade because the problem just lingered," said Lee. On protectionism, Lee said the openness of the U.S. economy had for years driven the increase in global trade and rising prosperity, all of which was at stake if the U.S. turned inward. "If America turns inward, it is going to do the world a lot of harm and do themselves a lot of harm," he said.

-

Weekly Update - 23 Feb to 01 Mar

kueytoc replied to iskay's topic in Weekly LFS Stocks Report / LFS Info Centre

Coral Farm...Fiji Exquisite Wrasseys, Scotts Fairys Wrasseys, Orangy Banded Garden Eels Hint: Hurry Hurry. -

-

Weekly Update - 23 Feb to 01 Mar

kueytoc replied to iskay's topic in Weekly LFS Stocks Report / LFS Info Centre

-

Weekly Update - 23 Feb to 01 Mar

kueytoc replied to iskay's topic in Weekly LFS Stocks Report / LFS Info Centre

-

Weekly Update - 23 Feb to 01 Mar

kueytoc replied to iskay's topic in Weekly LFS Stocks Report / LFS Info Centre

-

Sad to say that it's unlikely to survive mate.

-

Weekly Update - 23 Feb to 01 Mar

kueytoc replied to iskay's topic in Weekly LFS Stocks Report / LFS Info Centre

U will drool non-stop...if U know the SOURCE of shipment. -

No worries...moi 'Quickie Hand' is The Equipment !

-

Not so SOONZZZ...Prepare for tough times: PM S'pore economy may shrink by 5%: PM Lee Reuters - Monday, February 23 SINGAPORE, Feb 23 - Singapore's economy could contract by more than a government forecast of between -2 and -5 percent this year if the global economy continues to shrink, the Business Times quoted Prime Minister Lee Hsien Loong as saying. "Our GDP growth is forecast to be between -2 and -5 percent. It could be worse if the global economy worsens, even lower than -5 percent is possible," Lee was quoted as saying at a government function on Sunday. The government slashed its growth projection on Jan 21 to a contraction of between 2 and 5 percent, from a range of minus 2 percent to plus 1 percent. Like other export-reliant Asian economies, tiny Singapore has been pummeled by a collapse in consumer demand as economies slow sharply around the world. In January, Lee said the government's S$20.5 billion ($13.4 billion) stimulus package would not immediately lift the country out of a recession, which may possibly last for the whole of 2009. In the speech to unionists and white collar professionals on Sunday, Lee said the next six months would be tough for Singapore as economic fallout in Eastern Europe could worsen the global recession, led by tthe United States and the European Union. "It is a big problem for the European banks who are exposed to Eastern Europe, it is a problem for Asia too because the same European banks are very active and big lenders in Asia," the Strait Times quoted him as saying. "So let us prepare for a very tough year ahead and let us be psychologically raedy to think in terms of several slow years after that." Last month the government said in its budget it would for the first time tap government reserves to pay for a stimulus package to help companies and save jobs, as the country grapples with its worst-ever recession. Singapore's non-oil exports fell 34.8 percent in January from a year earlier, the worst fall since records began in 1977, and analysts said the worst is yet to come. Lee said the next two quarters would be "especially tough and let's fasten seat belts."

-

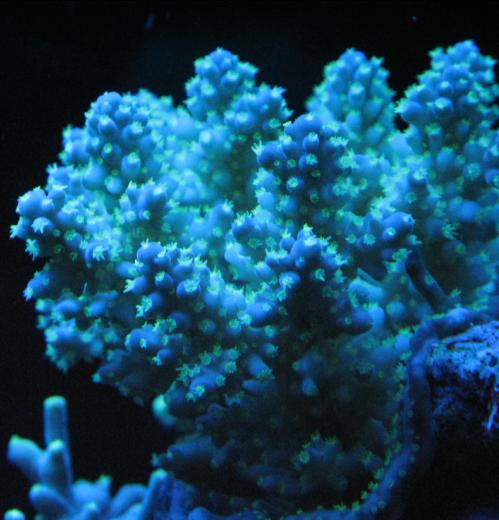

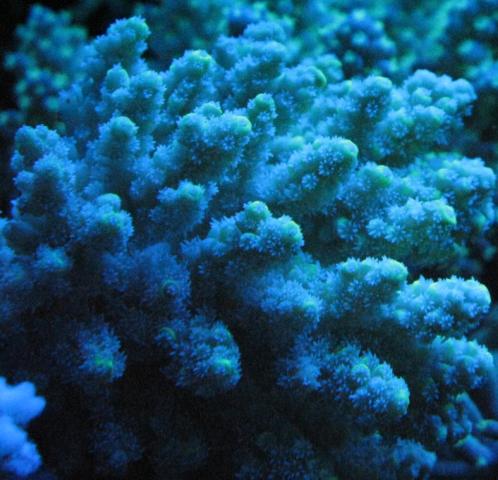

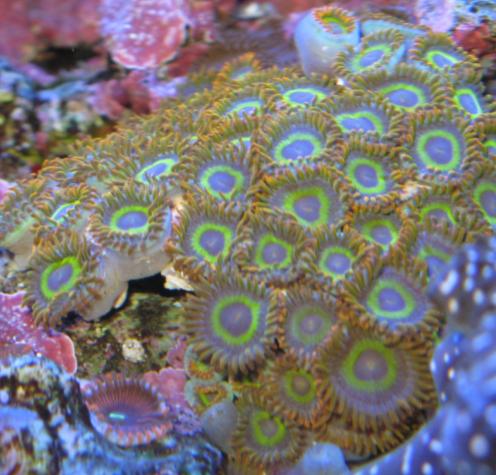

WOW...simply GORGEOUS mate ! Can frag some ???

-

Frag...Frag !!!

-

WAH !...moi can 'smell' some gem fraggies here.

-

GIC lost SGD50B last year: sources Singapore's GIC losses about 33 bln US dlrs: sources AFP - Wednesday, February 18 SINGAPORE, Feb 17, 2009 (AFP) - Government of Singapore Investment Corp, which has helped bail out troubled global financial institutions, suffered an investment loss of about 50 billion Singapore dollars (33 billion US) last year , sources told Dow Jones Newswires on Tuesday. In late 2007 and early last year GIC injected billions of dollars into Swiss bank UBS as well as US banking giant Citigroup, both of which suffered massive losses from US subprime, or higher-risk, mortgage investments. Subprime troubles later evolved into the worldwide financial slowdown. "The loss on the investment portfolio last year is estimated at around 45 billion to 50 billion," one of two people familiar with the GIC situation told Dow Jones. "But, GIC has no thoughts to sell down any of its major investments. They'll wait until they recover." UBS this month posted an annual loss of 17 billion US dollars, the largest in Swiss corporate history, and announced 2,000 new job cuts. A second person said GIC's investment loss last year was "recently estimated to be similar to Temasek's." The portfolio of Singapore sovereign wealth fund Temasek Holdings, which helped bail out Wall Street icon Merrill Lynch, fell about 31 percent over eight months last year, Senior Minister of State for Finance Lim Hwee Hua told parliament last week. She said Temasek's portfolio of investments fell to 127 billion dollars at the end of November, down 58 billion from 185 billion dollars on March 31 last year. Lim said it was not the first time GIC and Temasek had seen major declines in markets, and that GIC had "creditable returns" over the 20-year period to late 2008. Asked for comment on the Dow Jones report, a GIC spokesman said the firm did not comment on "speculative reports". GIC, one of the world's largest sovereign wealth funds, in September said its nominal rate of return over the 20 years to March 31 last year was 7.8 percent in US dollar terms. "Temasek and GIC are long-term investors, and should be evaluated as such," Lim said. "GIC and Temasek have the ability and resources to weather the ups and downs, over multiple economic and market cycles."

-

-

Here we go again...SIA to cut costs: ground staff, planes !!! Singapore Airlines to cut capacity, ground planes AP - Monday, February 16 SINGAPORE - Singapore Airlines Ltd. said it plans to reduce flights and ground more than a dozen planes as people travel less amid the global economic slowdown. The carrier said it will reduce capacity by 11 percent between April and March 2010 from the previous twelve months and decommission 17 aircraft after air cargo shipments fell 20 percent recently. "The drop in air transportation has been sharp and swift," the company said in a statement Monday. "We have to face the reality that 2009 is going to be a very difficult year." Singapore Airlines said last month that it planned to cut flights to the U.S., Europe and Asia as demand dried up. The airline said last week its October-December profit fell 43 percent as it flew 4.2 percent fewer passengers. The airline said it met with worker unions Monday to discuss voluntary leave without pay, voluntary early retirement and shorter work months. Managers will cut their salaries first if necessary, the carrier said. "We will contemplate retrenchment only as a last resort, but we do not have the luxury of time," the company said. "We need to agree and act on some measures quickly so that we can push back the point of retrenchment as far as possible." Singapore is facing its worst recession since splitting from Malaysia in 1965 as exports plummet. Gross domestic product shrank a seasonally adjusted, annualized 16.9 percent in the fourth quarter, and the government expects GDP in 2009 to contract as much as 5 percent.

-

Singapore exports in biggest fall on record: govt AFP - Tuesday, February 17 SINGAPORE (AFP) - - Singapore's key exports in January fell by the largest amount on record, the government said Tuesday, releasing data showing further evidence of the city-state's deepening recession. Non-oil domestic exports (NODX) fell by 34.8 percent in January compared with the same month a year earlier, said International Enterprise Singapore, the government's trade promotion agency. It is the biggest fall since the government began year-on-year comparisons in 1977 and exceeds the previous record of a 30.7 percent drop in September 2001, after Al-Qaeda's attacks on the United States. January's decline was the ninth consecutive contraction and was almost in line with the 34.5 percent median forecast in a poll of economists by Dow Jones Newswires. The decline last month exceeded the 20.8 percent year-on-year fall recorded in December, the data showed. Shipments to all 10 key markets were lower in January, with exports to the major United States market falling 50.0 percent, the agency said. The city-state is Southeast Asia's wealthiest economy in terms of gross domestic product per capita but its heavy dependence on trade makes it sensitive to economic disturbances in developed nations, whose economies are suffering in the world's worst economic crisis since the Great Depression of the 1930s. Singapore in October became the first Asian economy to enter recession. NODX to China -- whose economy slowed dramatically at the end of 2008 -- were down 51.6 percent, the agency said. On a month-on-month seasonally adjusted basis, NODX fell by 3.2 percent in January after the previous month's 11 percent decrease, it added. The key exports were worth 10.04 billion Singapore dollars (6.69 billion US) in January, a fall of 34.8 percent from a year earlier, data showed. Almost 40 percent of the NODX value comes from electronic products such as disk drives but the category fell by 38.4 percent last month. That was the sector's worst single-month fall since September 2001, said Song Seng Wun, regional economist with CIMB-GK Research. Non-electronic exports, including chemicals, petrochemicals and pharmaceuticals, were down 32.4 percent, International Enterprise Singapore said. Overall, the January fall was bad, "but it could have been worse," Song said. "It's bad, but in line with what we see in Taiwan, Korean and Chinese markets." Singapore twice downgraded its growth forecasts in January. The government now sees shrinkage of between 2.0 and 5.0 percent for this year, after estimated growth of 1.2 percent in 2008. But Finance Minister Tharman Shanmugaratnam warned this month the economic crisis will be drawn out. "We are seeing continued momentum in the economy declining week by week," he said.

-

What 'Love Potion' did U use ?

-

for your 'Alarm Bells' mate. Alas ! managed to grab 2 decent SCOOTEROOs which I certainly hope could pair up soon.

-

-

Could be ya 'sleepy eyes' playing tricks on U.

-

We will survive crisis: Minister Trade minister says Singapore poised to weather downturn Channel NewsAsia - Tuesday, February 10 SINGAPORE: Trade and Industry Minister Lim Hng Kiang said the country’s GDP forecast of —5 per cent to —2 per cent reflects a sober yet realistic view of the economic prospects for 2009. Outlining the year ahead, Mr Lim also noted that there are reasons to be optimistic. He told Parliament on Monday that faced with the current recession, the country is better off for pursuing strong economic growth in the good years. Mr Lim said the critical uncertainty is the recovery of the G3 economies, Japan, the EU and particularly the US. He gave the strategic rationale behind the GDP forecast of between —5 and —2 per cent. Mr Lim said: "The higher end of our forecast range is premised on the G3 economies recovering albeit weakly, in the second half of 2009. The lower end of our forecast range is based on the G3 economies not recovering until 2010." So to help companies tide over this period, the government’s strategy is to help ease cashflow. Adding to schemes like the Jobs Credit and Special Risk—sharing Initiative will be the Export Coverage Scheme from next month. The aim is to provide better access to trade credit insurance cover for Singapore—based companies. IE Singapore will administer the scheme, which is expected to support up to S$4 billion worth of trade turnover and benefit some 1,000 Singapore—based companies. Credit financing and cost alleviation aside, Mr Lim noted companies will also need to develop capabilities to take advantage of the eventual upturn. So the government will set aside S$660 million over the next two years to help companies seek new markets and growth opportunities. IE Singapore, tasked with spearheading the development of Singapore’s external trade, will set aside S$66 million to enhance its internationalisation and export—promotion activities. Singapore’s enterprise development agency, SPRING, will enhance its capability development schemes under a new S$200 million programme called the Business Upgrading Initiatives for Long—term Development (BUILD). As for the performance of individual industry clusters, the general sense is that while all major sectors like petrochemicals, biomedical manufacturing and precision engineering are hit, all are positioned for growth. For example, the biomedical manufacturing sector will increase its hiring by bringing in 900 jobs this year. Moving forward, Mr Lim said while Singapore’s small size makes it more vulnerable to global markets, it also allows the country to respond more nimbly to opportunities when they arise. Mr Lim said: "Growth has helped us to build up healthy balance sheets. Growth has helped us to build up valuable skills and capabilities in our industry sectors and in our workers. Growth has made possible a strong investment pipeline that is helping to create jobs even through this recession." Mr Lim added that also going for Singapore is the Asian growth story, which is still intact. With the region poised for rapid recovery, he said Singapore will be ready to capture the new opportunities. — CNA/vm

-